Welcome to the August edition of “Finsights” where I publish fundamental analysis on one listed Indian company every month. If you like what you read, why not subscribe so that you can receive my posts right in your inbox as soon as they are published!

I started looking at Heritage Foods Ltd. since it showed up on one of my screens earlier this year and below I present my analysis of last 10 year standalone financials of this dairy business.

Before I begin, a standard disclaimer that the below does NOT constitute investment advice. I have No position in the stock as of now but might take in the future.

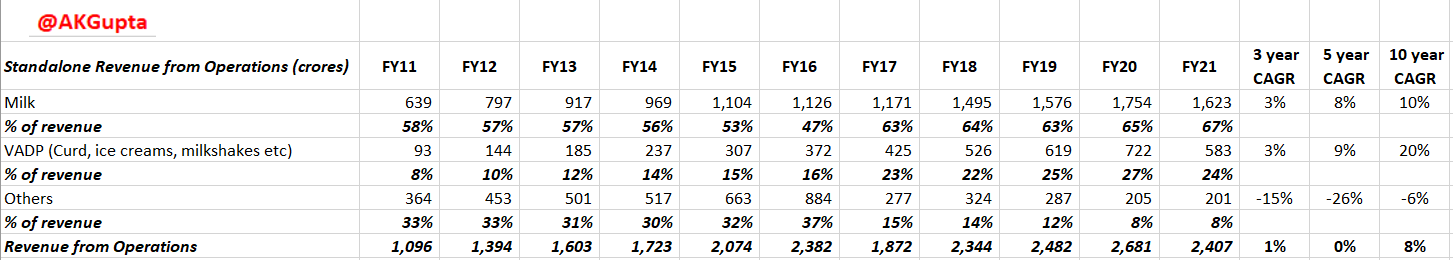

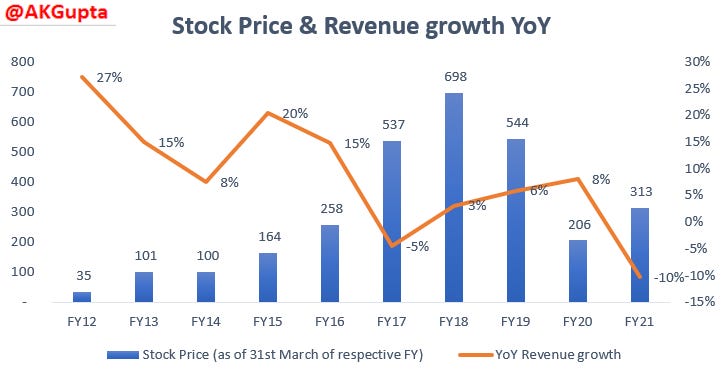

Heritage primarily sells processed milk (67% revenue in FY21) and Value Added products like curd, ice-creams, milk shakes etc. (24% of revenue in FY21) in South India. Revenue has grown at 8% pa CAGR over last 10 years but has since slowed down to 1% 3 year CAGR and 0% 5 year CAGR (see trend below). This is only partly because of COVID. Primarily this is due to the politically sensitive nature of this stock.

I. Political sensitivity + Farmer sensitivity + Geographic concentration in South India : Heritage Foods was started in 1990s by N. Chandrababu Naidu, former Chief Minister of Andhra Pradesh & his wife and daughter-in-law are MD and ED of the company respectively. Suffice to say the company is likely to do better in times when the Naidu family is leading the Andhra Pradesh govt. Notice the difference in revenue growth when Mr. Naidu was CM from 2014-19 (20% in FY15 & 15% in FY16) & from FY19 onwards (6% in FY19 and 8% in FY20).

Stock Price similarly performed very well when Mr. Naidu was in power - giving 40% annualized return in 2014-19 & (-24)% annualized return after 2019.

Combination of politics, farmers & geographic concentration doesn’t bode well for long term investors and I usually tend to stay away. For eg. a political rival might target Heritage’s already meager margins & win himself/herself farmer’s political support as well by asking Heritage to pay higher prices for farmers’ raw milk.

Here is another example of how political rivalry might hurt Heritage investors. YS Jagan Mohan Reddy, new state CM elected in 2019, called out Heritage for buying land at dirt cheap prices because of Naidu’s political patronage & promised to investigate (at ~15 mins in this interview).

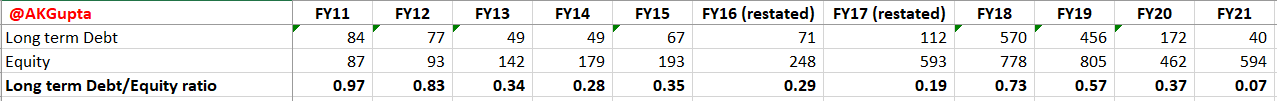

II. Future Group deal : The company sold its 124 Heritage Retail stores to Future Retail Ltd & received 1.78 crore shares for ₹295 crores in 2016. This stake has been sold in FY21 for ₹132 crores so the company made a loss on this deal due to debt woes at Future Group & its slump sale to Reliance. But the good thing is Heritage Foods used this money to pay down Long term debt and reduce leverage.

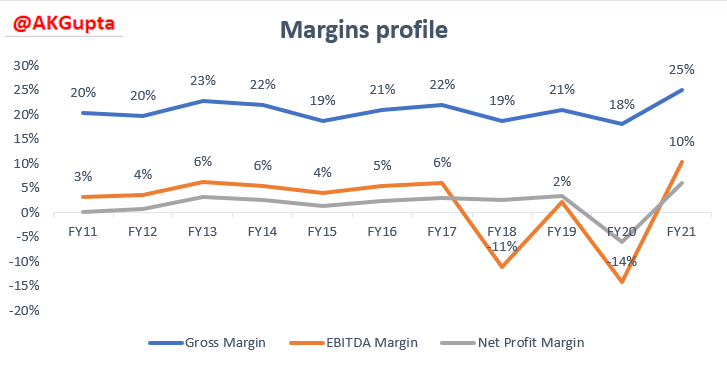

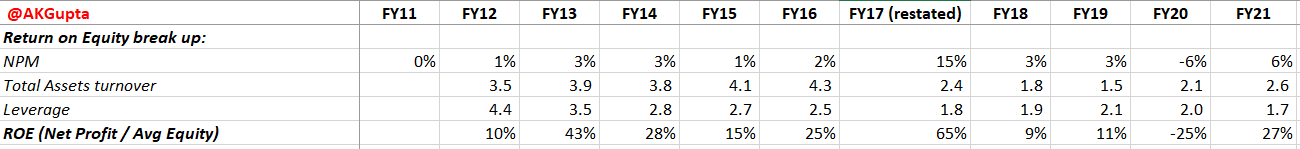

IV. ROE analysis : Net Profit margin is 2-3% and leverage is low implying that main driver of ROE performance is Asset turnover. in FY21, ROE jumped to 27% as a result of doubling of Net Margin to 6% and rebound in Assets Turnover as Future Group investments were disposed off. There is further scope for ROE expansion if Heritage achieves its Average Asset Turnover of 3.9 (from FY12-16).

Net margins sustainability at FY21 level & rebound in Assets turnover could be one potential source for re-rating in this stock.

Assuming a conservative 80% earnings retention and 20% ROE going forward, Heritage should grow earnings by ~15-16% pa. I am comfortable with this growth estimate also because earnings usually grow by 2x long term revenue growth which is 8% as seen above.

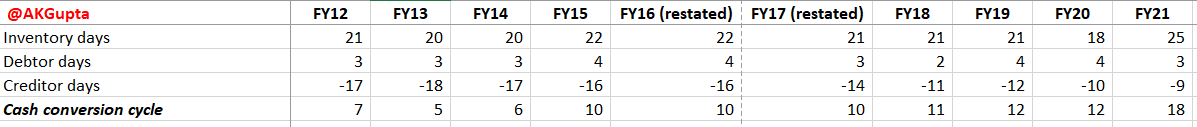

V. Working Capital Management : Dairy business is a “get paid first” business & this reflects in the Negative working capital trend & excellent cash conversion cycle of Heritage (see trend below) :

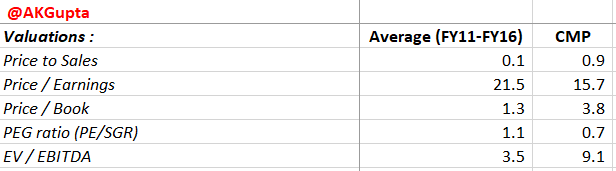

VI. Valuations at CMP are higher than FY11-FY16 averages (see below) : I have chosen this period to remove the impact of Future Group investments on P&L & valuation ratios from FY17-20

VII. Conclusion : From what we have seen above, Heritage is

mired in politics & farmer issues with geographical concentration in South India,

improving margin profile (if sustained by growth in Value Added Products %),

has healthy ROE (if improved by rebound in Asset Turnover to historical avg),

declining leverage

excellent Working capital mgt., &

Balance Sheet issues related to Future Group investments cleaned up

That’s it for this month folks. See you next month with another deep dive into one interesting listed business!

Great job Aakash as always..very precise! I look forward to your monthly articles :)

Great blog Aakash can we post your blog on Finbloggers Mobile application under your name and web link. Finbloggers is an aggregator of blogs related to the Indian Stock Market with an active reader base of 13000+ users across 151 countries